- PRESS RELEASE

Survey on the Access to Finance of Enterprises: moderate tightening in reported financing conditions

15 July 2024

- Euro area enterprises signalled more positive developments as regards the supply of bank loans, reflected in a slight increase in bank loan availability, fewer obstacles to obtaining loans, as well as an improvement in banks’ willingness to lend.

- Fewer firms recorded a moderate tightening of financing conditions in the second quarter of 2024. Firms reported a slight reduction in the need for bank loans and improvements in the availability of bank loans. As a result, there was a small decrease in the bank financing gap with respect to the previous quarter.

- More enterprises reported an increase in turnover over the last three months, and firms were optimistic about developments in the next quarter. Fewer firms saw a deterioration in profits, while increases in labour and other costs were indicated less often than in the previous quarter. Cost pressures remained widespread.

- A small share of firms in net terms indicated an increase in average hours worked in the second quarter of 2024, which was mostly associated with an increase in demand for own products and services and difficulties in hiring labour. The increase was driven by the services sector.

- Firms expected their selling prices and wages increases to moderate over the next 12 months, with average increases of 3% and 3.3% respectively. Firms in the services sector expect a larger increase in selling prices, wage costs, non-labour input costs and employment over the next 12 months compared with other sectors.

- Firms’ inflation expectations declined, with their median expectations for annual inflation in one, three and five years all standing at 3.0%. A high share of firms (50%) considered that risks to the inflation outlook in five years were tilted to the upside, rather than the downside (10%).

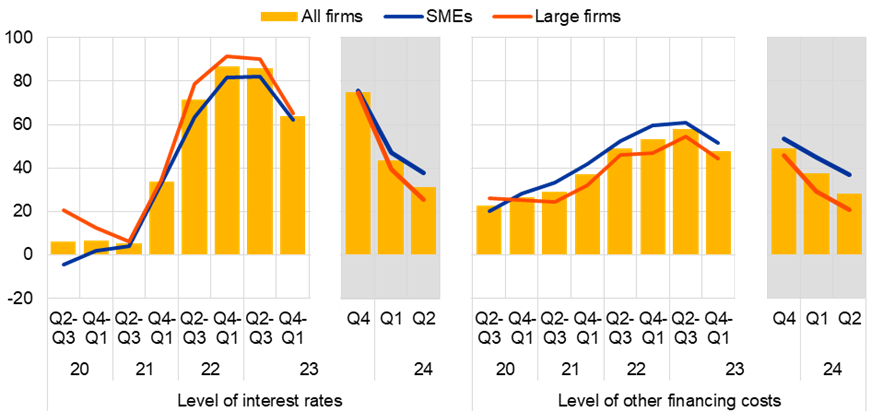

In the 31st round of the Survey on the Access to Finance of Enterprises (SAFE), fewer euro area firms indicated a tightening of financing conditions in the second quarter of 2024 compared with the first quarter. The net percentages of firms reporting increases in interest rates on bank loans and increases in other financing costs (i.e. charges, fees and commission) both declined, falling to 31% (after 43% in the previous quarter) and 28% respectively (after 37% previously, Chart 1).

In this survey round, a net 1% of firms reported a decline in the need for bank loans in the second quarter of 2024, similar to the first quarter. At the same time, a net 2% of firms indicated an improvement in the availability of bank loans, compared with a net 3% reporting a deterioration in the first quarter of 2024. This led to the bank financing gap (the difference between the need for and availability of bank loans) decreasing for a net 1% of firms, compared with an increase for a net 2% of firms in the previous survey round. Looking ahead, firms have become more optimistic about the availability of bank loans over the next three months.

Firms perceived the general economic outlook to be the main factor hampering the availability of external financing, albeit to a much lesser extent than in the previous survey round (with a net percentage of -12%, up from -26%). At the same time, their perceptions of banks’ willingness to lend, which may reflect banks’ risk aversion, improved further (with a net percentage of 9%, up from 4%).

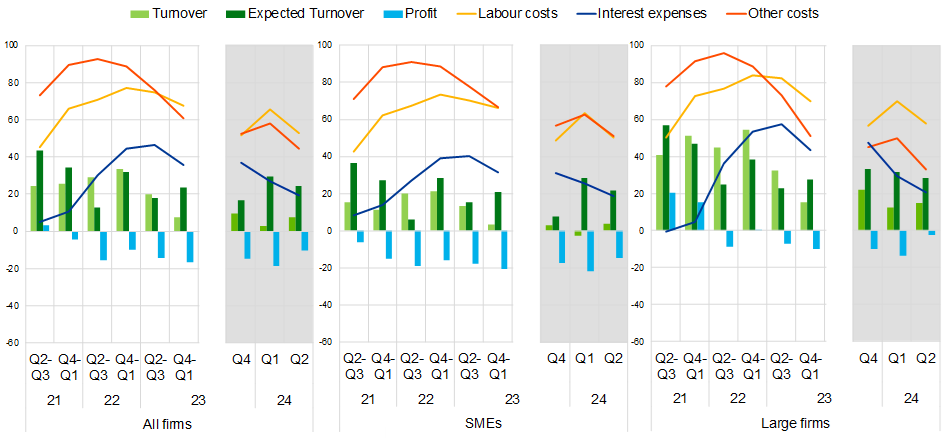

A net 8% of enterprises reported an increase in turnover over the last three months, up from 3% in the previous survey round. Firms were optimistic regarding developments in the next quarter (Chart 2). Fewer firms saw a deterioration in their profits compared with the previous survey round (with a net percentage of -10%). The survey indicates that cost pressures continue to be widespread across businesses of all sizes, even if these are decreasing slightly.

To better understand labour market developments, a new set of ad hoc questions was introduced in this survey round. Firms were asked about the change in average hours worked in the second quarter of 2024 and contributing factors. Most firms did not see a change in average hours worked, with a net 2% of firms indicating an increase in average hours worked over the last three months. A net 10% of firms indicated a decrease in industry and a net 7% of firms an increase in services.

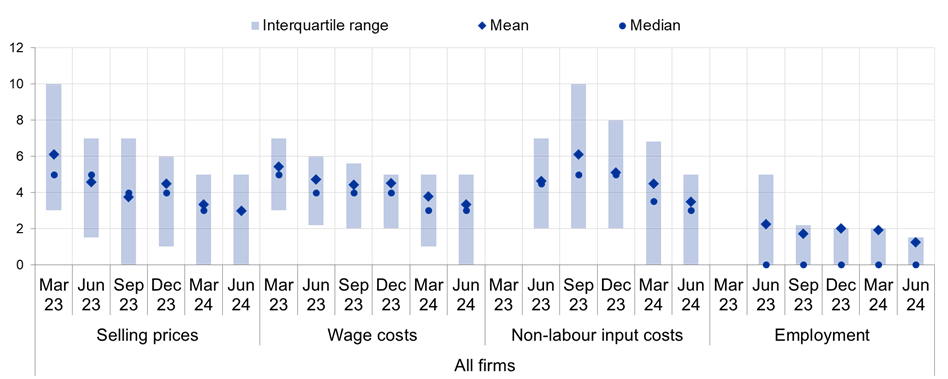

Firms expected the increase in their selling prices and wages to moderate over the next 12 months (Chart 3). Selling prices were expected to increase by 3% on average (down from 3.3% in the previous survey round), while the corresponding figure for wages was 3.3% (down from 3.8% in the previous round).

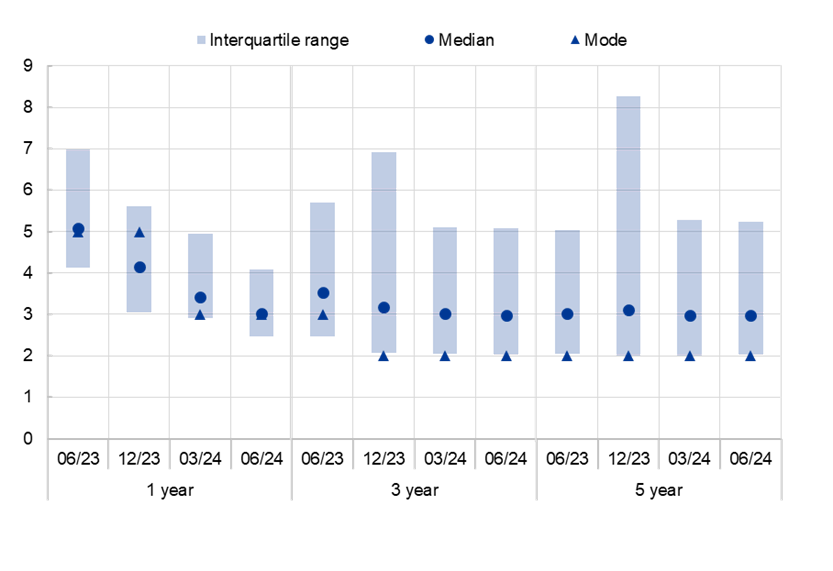

Firms’ inflation expectations continued to decline, and the dispersion also moderated at the one-year horizon (Chart 4). Median expectations for annual inflation in one, three and five years all stood at 3.0%, thus declining by 0.4 percentage points for the one-year horizon and remaining stable for the three and five-year horizons. For inflation in five years, 50% of firms perceived that the risks to the outlook were tilted to the upside, compared with just 10% who considered that the risks were on the downside.

The report published today presents the main results of the 31st round of the SAFE survey for the euro area. The survey was conducted between 28 May and 20 June 2024 and covered the period from April to June 2024. Firms were asked about conditions over the three-month period from April to June 2024. The sample comprised 5,940 enterprises in the euro area, of which 5,431 (91%) had fewer than 250 employees.

For media queries, please contact Silvia Margiocco, silvia.margiocco@ecb.europa.eu, tel.: +49 69 1344 6619.

Notes:

- The report on this SAFE survey round, together with the questionnaire and methodological information, is available on the ECB’s website.

- Detailed data series for the individual euro area countries and aggregate euro area results are available on the ECB Data Portal.

Chart 1

Changes in the terms and conditions of bank financing for euro area enterprises

(net percentages of respondents)

Base: Enterprises that had applied for bank loans (including subsidised bank loans), credit lines, or bank or credit card overdrafts. The figures refer to rounds 23 to 31 of the survey (April-September 2020 to April-June 2024).

Notes: Net percentages are the difference between the percentage of enterprises reporting an increase for a given factor and the percentage reporting a decrease. The data included in the chart refer to Question 10 of the survey. The grey areas represent responses to the same question within a reference period of three months, whereas the main chart covers a reference period of six months for the survey questions.

Chart 2

Changes in the income situation of euro area enterprises

(net percentages of respondents)

Base: All enterprises. The figures refer to rounds 25 to 31 of the survey (April-September 2021 to April-June 2024).

Notes: See the notes on Chart 1. The data included in the chart refer to Question 2 of the survey. The grey areas represent responses to the same question within a reference period of three months, whereas the main chart covers a reference period of six months for the survey questions.

Chart 3

Expectations regarding selling prices, wages, input costs and employment one year ahead

(percentage change over the next 12 months)

Base: All enterprises. The figures refer to round 28 (October 2022-March 2023), the first pilot (March-June 2023), round 29 (April-September 2023), the second pilot (October-December 2023), round 30 (January-March 2024) and round 31 (April-June 2024), with firms’ replies collected in the last month of the respective survey waves.

Notes: Euro area firms’ mean and median expectations regarding changes in selling prices, wages of current employees, non-labour input costs and number of employees for the next 12 months, along with interquartile ranges, using survey weights. The statistics are computed after trimming the data at the country-specific 1st and 99th percentiles. The data included in the chart refer to Question 34 of the survey. Questions on non-labour input costs and employees were not available in round 28.

Chart 4

Firms’ expectations about euro area inflation at different horizons

(annual percentages)

Base: All enterprises.

Notes: Survey-weighted medians, modes and interquartile ranges for firms’ expectations about euro area inflation in one, three and five years. Quantiles are computed by linear interpolation of the mid-distribution function. The statistics are computed after trimming the data at the country-specific 1st and 99th percentiles. The data included in the chart refer to Question 31 of the survey.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts